Economic Substance in BVI – Changing Laws

NoticesNew Legislation Enacted

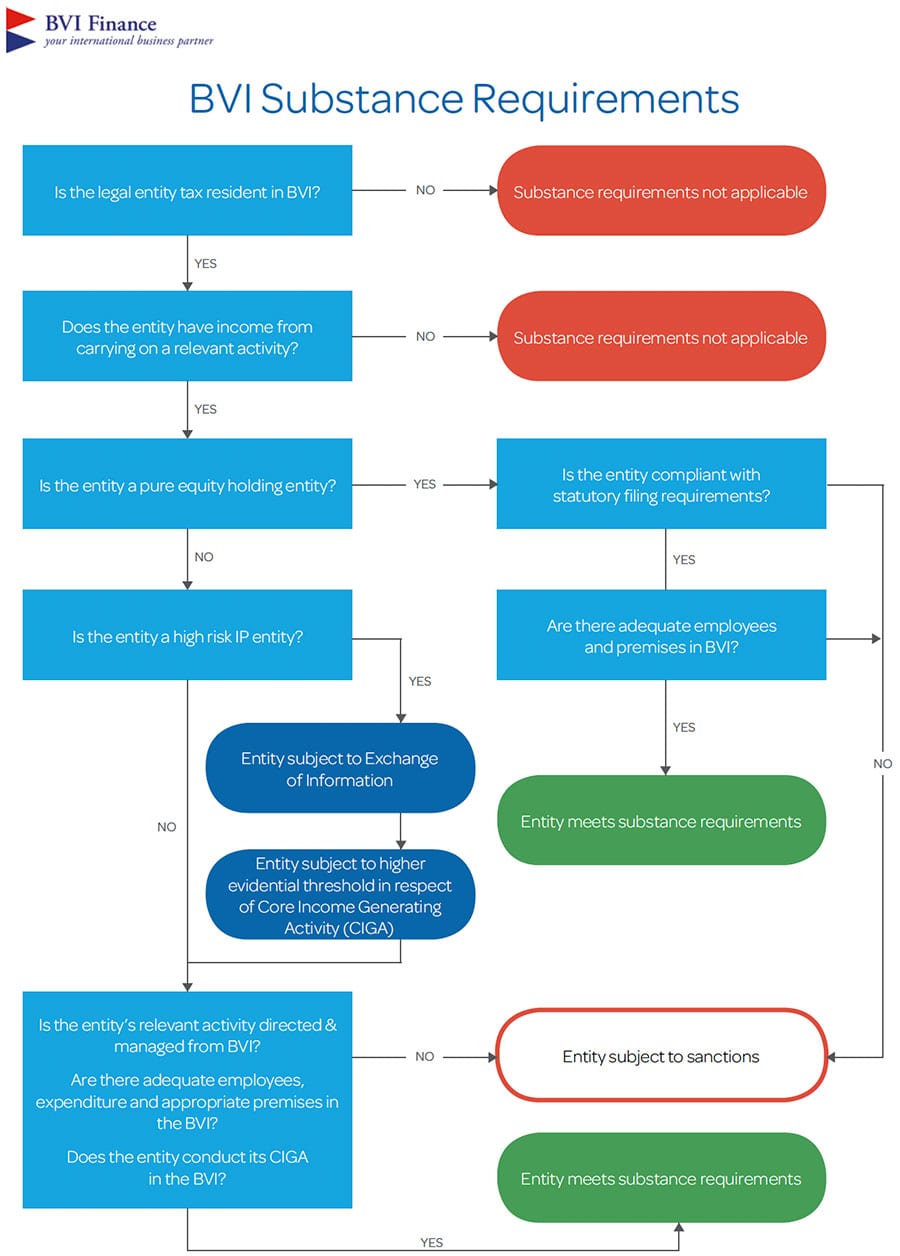

The British Virgin Islands has enacted legislation, effective 1 January 2019, that requires companies claiming tax residence in the territory to meet certain BVI substance requirements. I have attached an excellent introductory memorandum drafted by lawyers Appleby, and a helpful flow chart (produced by BVI Finance) illustrating the determination process.

This BVI legislation is very similar to laws also introduced in the Crown Dependencies and other British Overseas Territories and seeks to better define what is required for a company or partnership to achieve local tax residence. We are awaiting the publication of supporting regulations for more detail on how this will be determined in practice, but my understanding is that if the directors are already fulfilling their role properly, there should be limited impact. If a company is not claiming to be tax resident in BVI, we will have to disclose its tax residence on the BOSS system.

Our Involvement

Chorus International Services (BVI) Limited has now been approved by BVI’s Financial Services Commission and we are working through the final formalities to licensing. We will be delighted to help with the provision of substance directors and governance proposals upon the formal issue of our license.

Technical Updates

We think it important that ChorusGlobal engage in an active programme of “knowledge-sharing” with its partners and we have a range of initiatives furthering this aim, including:

- the drafting and provision of guidance notes;

- drafting and circulating our own advisories and tutorials on hot-button topics; and

- distributing memoranda and circulars produced by third-party subject experts that we believe are relevant, adding our own comments where we think it may help.

If you have received this communication, you are already on our mailing list. If you wish to be removed from the list, please let us know.

Posted on

Nicholas Lane

Managing Director

Original Post from Appleby

Economic substance requirements in the British Virgin Islands

The British Virgin Islands (BVI) government has enacted legislation that will require certain BVI entities carrying on specified activities to have ‘adequate substance’ in the BVI. Any relevant entity that may be impacted by this legislation will wish to monitor these developments closely.

Background

As an early adopter of the Common Reporting Standard and FATCA compliant, the BVI is recognised as a jurisdiction committed to tax transparency. The BVI anti-money laundering and anti-terrorist financing legislative regime meets or exceeds international standards and the BVI government and financial services industry have worked closely with intergovernmental organisations to maintain a sound regulatory framework.

In 2017 the EU Code of Conduct Group (the Code Group) assessed the tax policies of a range of jurisdictions, including the BVI. Following this assessment, the BVI was included in a list of jurisdictions which were required to address the Code Group’s concerns about ‘economic substance’. Like their counterparts in the Cayman Islands, Bermuda, Guernsey, Jersey and Isle of Man, the government of the BVI has been working closely with the Code Group to ensure that such concerns are adequately addressed. As a result of this engagement, the Economic Substance (Companies and Limited Partnerships) Act, 2018 (the Act), has been enacted, coming into force on 1 January 2019.

Applicability

The Act applies to all “legal entities” carrying on “relevant activities”, other than non-resident companies, non-resident limited partnerships and limited partnerships which have elected not to have legal personality.

Legal entities are defined as being BVI companies and limited partnerships, and foreign companies and foreign limited partnerships registered in the BVI under the BVI Business Companies Act, 2004 or the Limited Partnerships Act, 2017.

A non-resident company or non-resident limited partnership is a company or limited partnership which is resident for tax purposes in a jurisdiction outside the BVI (except for jurisdictions which have been included on the EU list of non-cooperative jurisdictions).

The effect is that the economic substance requirements are to be imposed on all legal entities carrying on “relevant activities” unless they can demonstrate that they are tax-resident elsewhere. A legal entity is subject to the economic substance requirements if it conducts any of the following “relevant activities”:

- banking business

- insurance business

- fund management business

- finance and leasing business

- headquarters business

- shipping business

- holding business

- intellectual property business

- distribution and service centre business.

Each of the above activities is defined in the Act, and we expect that further guidance will be issued to assist in determining if a particular entity is carrying on a relevant activity.

For further information on the changing legislation please contact your usual Appleby contact.

Subscribe to Chorus Global’s Notices

If you want to stay up to date with our services and news, subscribe to our Newsletter.

Chorus International Services (BVI) Limited

P.O. Box 4203

Road Town, Tortola

British Virgin Islands

VG1110

Services

BVI Economic Substance Update August 2019

OECD approves BVI’s Economic Substance legislation Following the British Virgin Islands’ (BVI) enactment of the Economic Substance (Companies and Limited Partnerships) Act of 2018, the OECD’s Forum on Harmful Tax Practices (FHTP) has acknowledged that the BVI’s...